Are you an investor who wants to measure the effectiveness of your investment? Annualized Rate of Return (ARR) is a useful tool that can help you do just that. In this article, we will explore what ARR is, how to calculate it, and provide examples to help you understand how it works.

What is Annualized Rate of Return (ARR)?

Annualized Rate of Return is a metric used to measure the return on investment (ROI) over a specific period. It shows the percentage increase or decrease in the value of an investment, taking into account the time value of money.

ARR is commonly used to compare the effectiveness of various investment opportunities. It is especially useful when analyzing investments with different holding periods. This is because ARR allows you to compare the returns on investments with different holding periods on an equal footing.

How does Annualized Rate of Return Work?

Annualized Rate of Return (ARR) works by measuring the total return on an investment over a specific period, and then adjusting the return to reflect the time value of money. The time value of money is the concept that money today is worth more than the same amount of money in the future due to factors such as inflation and the potential earning capacity of the money if invested elsewhere.

To calculate ARR, you first need to determine the total return on your investment by subtracting the initial value from the final value. Next, you need to calculate the holding period in years, which is the amount of time between the initial investment and the final value of the investment. Finally, you can use a formula to calculate the annualized rate of return, which takes into account the total return and the holding period.

ARR is a useful tool for investors because it allows them to compare the returns on investments with different holding periods on an equal footing. For example, an investment that returns 10% over a period of one year may not be as effective as an investment that returns 8% over a period of three years, when the ARR is taken into account.

By using ARR, investors can make more informed investment decisions and better assess the performance of their investments.

How to Calculate Annualized Rate of Return?

To calculate ARR, you need to follow a simple formula. First, you need to calculate the total return on your investment. This is the difference between the final value of your investment and the initial value of your investment.

Total Return = Final Value – Initial Value

Once you have calculated the total return, you need to calculate the holding period in years. This is the time period between the date of the initial investment and the date of the final value of the investment.

Holding Period = Final Date – Initial Date / 365

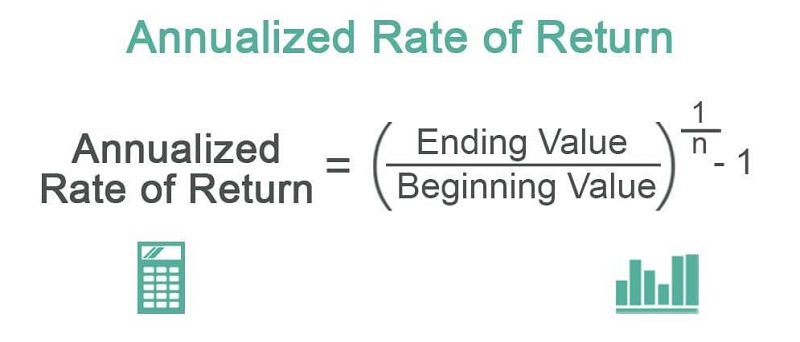

Finally, you can calculate the Annualized Rate of Return by using the following formula:

ARR = (1 + Total Return)^(1/Holding Period) – 1

Let’s illustrate this with an example:

Suppose you invested $10,000 in a mutual fund on January 1, 2019, and sold it for $15,000 on December 31, 2022. What is the Annualized Rate of Return?

Total Return = $15,000 – $10,000 = $5,000 Holding Period = (December 31, 2022 – January 1, 2019) / 365 = 3.008 years

ARR = (1 + $5,000/$10,000)^(1/3.008) – 1 = 0.1222 or 12.22%

The Annualized Rate of Return for this investment is 12.22%.

Conclusion

Annualized Rate of Return is a useful tool for investors to measure the effectiveness of their investments. By taking into account the time value of money and the holding period of an investment,

ARR allows you to compare the returns on investments with different holding periods on an equal footing. Using the formula provided in this article, you can easily calculate the ARR of your investments and make informed investment decisions.